Single Touch is the easy way to make your business compliant with the ATO's single Touch reporting requirements. It is a secure way to transmit your payroll data to the ATO.

The API provided by Single Touch is the most simple and efficient method to send your client's STP data to the ATO.

There are three options: Single Touch Lite (STP Lite), Single Touch Plus (ST Plus) and Single Touch Portal (STP Portal).

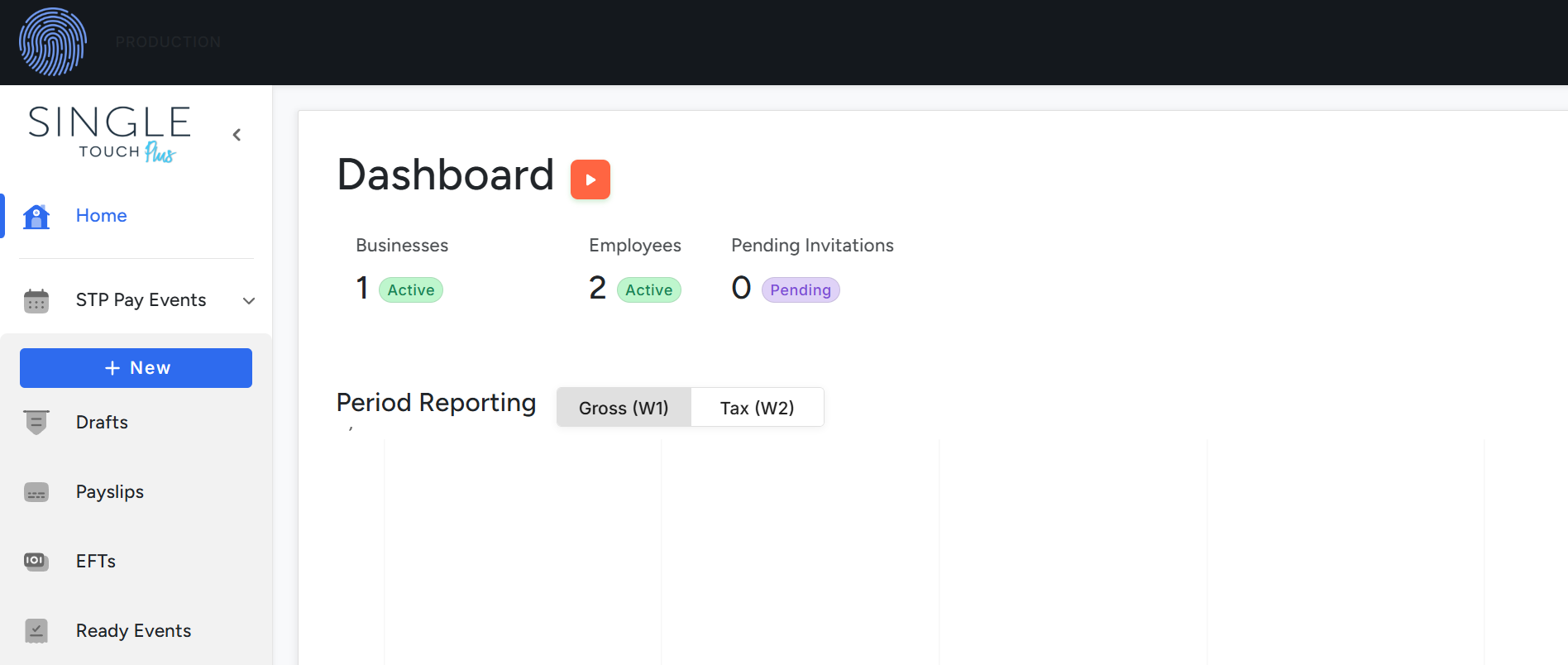

ST Plus:

ST Plus is a complete payroll solution with built-in STP reporting for small to medium Australian businesses.

ST Plus provides a complete payroll processing system with unlimited number of businesses (ideal for tax practicioners or accountants), automated pay and tax calculations, employee management, email payslips, leave management, built-in STP reporting and much more...

ST Plus: https://plus.singletouch.com.au

STP Lite:

STP Lite is the ATO STP reporting interface for employers who do not have a payroll system, or their payroll system does not have Single Touch reporting capabilities (no Product ID).

STP Lite offers both CSV file upload and direct data entry facilities.

STP Lite: https://lite.singletouch.com.au

STP Portal / API:

The STP Portal enables STP compatible software, that already has a Product ID, an affordable solution for sending STP Pay events to the ATO (via our STP gateway).

The Portal/API product offers JSON or XML RESTful API as well as CSV or XML file upload facilities (via web-portal) for Pay event transmission.

STP Portal: https://portal.singletouch.com.au

A Product ID is an ID given to software providers by the ATO to uniquely identify them. The software provider (software company) must register with the ATO as a "Software Provider" and go through testing of their software to obtain a Product ID.

To find out whether your payroll system has a Product ID or not, please contact your payroll software provider.

Yes, you have two options. STP Lite is accessible even without a payroll system. It offers a manual payroll data entry method, allowing you to fulfil your payroll reporting obligations with the ATO. For a more complete solution, we recommend ST Plus, which is a full payroll system with built-in STP reporting capabilities, employee management, and automated calculations.

STP Lite:

A fee of $0.25 per employee transmission is applicable to each ABN or ACN, with a minimum charge of $7.50. Admin fee of $9.50 applies when Direct Debit is not provided. All fees are invoiced monthly and please note, all values exclude Goods Services Tax (GST). No fees or charges will be incurred if no submissions are made during a month.

ST Plus:

$7.99 per month for the first 3 employees, $3.00 per additional employee, and $2.00 for terminated employees. All fees are invoiced monthly and all values exclude Goods Services Tax (GST). A 3-month free trial is available for new users.

STP Portal:

A fee of $0.10 per employee transmission is applicable to each ABN or ACN, with a minimum charge of $5. Admin fee of $9.50 applies when Direct Debit is not provided. All fees are invoiced monthly and please note, all values exclude Goods Services Tax (GST). No fees or charges will be incurred if no submissions are made during a month.

As per the ATO's instructions and guidelines, you are required to report a pay event to the ATO on or before the pay day. (pay day is the date on which you pay your employee's wages into their bank accounts).

For more information visit below link of the ATO: ATO Single Touch guidelines

As per the ATO's instructions, you must lodge your STP event, each time you have paid your employees; on or before the payment date. For example, if you pay our employees weekly then you must lodge your STP events weekly too.

Please Visit https://singletouch.com.au

Select STP Lite for employers without a payroll system who need basic STP reporting, ST Plus for a complete payroll solution with built-in STP reporting, or STP Portal for employers with a payroll system and a Product ID. Complete the sign up process and STP will guide you step by step.

You can find the full instructions in detail here for STP Lite, here for ST Plus or here for STP Portal

Yes, Single Touch is STP phase 2 compliant.

ST Plus is a complete payroll processing system with built-in STP reporting for small Australian businesses. It offers a user-friendly interface to manage all aspects of your payroll while ensuring compliance with ATO requirements. ST Plus was developed to provide a full-featured payroll solution that integrates seamlessly with STP reporting requirements.

ST Plus offers a comprehensive range of payroll features, including:

- Multi-business management for companies with multiple entities

- Employee leave management and tracking

- Professional payslip generation and distribution

- Pay templates for consistent and efficient processing

- Automated payroll processing with tax and superannuation calculations

- Comprehensive reports for financial analysis and record-keeping

- Multi-user access with permission controls

- STP compliance with automatic reporting to the ATO

- Advanced STP compliance features

- Error checking and validation to ensure accuracy

- Priority support for all users

ST Plus is a full payroll system while STP Lite is just for STP reporting. The key differences include:

ST Plus:

- Complete payroll processing capability

- Automated calculations for tax, superannuation, and other deductions

- Employee management features (onboarding, leave management, etc.)

- Payslip generation and distribution

- Comprehensive reporting tools

- Built-in STP reporting to the ATO

- Monthly subscription pricing model

STP Lite:

- STP reporting only - not a payroll system

- Manual data entry or CSV uploads

- No calculation capabilities

- Basic reporting focused on STP compliance

- Pay-as-you-go pricing model based on transmissions

Yes, ST Plus offers a 3-month free trial period for new users. This allows you to explore all features and functionality of the system before committing to a subscription. During the trial, you'll have full access to all features including STP reporting capabilities, payroll processing, and reporting tools.

Yes, you can migrate from STP Lite to ST Plus. The migration process allows you to transfer your existing employee data and historical STP reporting information to the new system. To begin the migration process, sign up for ST Plus and contact our support team who will guide you through the data transfer process. Your historical STP reporting data will be preserved, ensuring continuity in your ATO reporting obligations.

Yes, ST Plus automatically handles superannuation and tax calculations. The system is updated regularly to reflect current tax tables and superannuation requirements, ensuring that all calculations are accurate and compliant with Australian regulations. This automation reduces the risk of errors and saves time during payroll processing.

Yes, ST Plus supports multi-business management. You can set up and manage multiple business entities under a single account, each with its own ABN/ACN and configuration. This feature is particularly useful for accounting firms, bookkeepers, or business owners with multiple companies. Each business entity is billed separately according to the pricing structure based on the number of employees.

Clients are offered support during office hours (9am – 5pm) via email or phone (02) 94204638.

Yes, Single Touch requires Multi-Factor Authentication (MFA).

Single Touch is an ISO 27001 certified company and security and safe-keeping of your data is of paramount importance to us. We use industry standard encryption both for data transmission and data storage and pride ourselves on the level of security and protection we maintain.

Yes, you can give access to your company's data to your accountant, bookkeeper or BAS agent. You must ensure that they follow best practice security and privacy procedures when dealing with confidential employee information.

On STP Lite, ST Plus, or STP Portal, you can register as many entities as you need. ST Plus includes multi-business management specifically designed to help you manage multiple entities under a single account.

On STP Lite, ST Plus, or STP Portal, you can register as many employees as you need. Each product has its own pricing structure based on the number of employees, but there is no technical limitation on how many employees you can register.

No, Single Touch does not include a self-service portal for employees or managers.

No, at the moment we do not have a phone app, but you can access the website on any internet connected device (including mobile phones) via a browser.

For STP Lite and STP Portal, there is no trial period, however set up is free. You can register your business and access straight away to evaluate whether our product suits your business requirements.

Important to note, if you transmit payroll data using STP Lite or STP Portal, an invoice will be auto generated at the end of the month.

For ST Plus, we offer a 3-month free trial that includes full access to all features. You can use the complete system, including its payroll processing and STP reporting capabilities, without any charges during this trial period.

Yes. All Single Touch products (Lite, Plus, and Portal) provide a suite of reports designed for payroll reconciliation. ST Plus offers the most comprehensive reporting, including a range of payroll, tax, and employee reports to help with financial analysis and record-keeping.

No. Data can only be transmitted to the ATO from approved Software Providers using their fixed file format. Single Touch Lite is such an approved Software Provider.

Yes, accountants or BAS agents can use all Single Touch products. Single Touch has different types of users and access levels including BAS agent, Executive BAS agent, normal and executive users.

For BAS Tax Agents who represent several companies, Single Touch has a SPONSOR facility.

If you become a Sponsor for your clients, you will receive one invoice each month for the total amount.

ST Plus offers specific features for accountants and tax agents, including multi-business management and enhanced reporting to help you service multiple clients efficiently.

Yes, you are able to send STP events of prior financial years via Single Touch.

Yes, as long as you have sent your events via any of our products - STP Lite, ST Plus, or STP Portal. All Single Touch products support end-of-year finalisation of employee records for ATO reporting purposes.

Yes, you are able to amend your employees' previous financial years via any of our products (STP Lite, ST Plus, or STP Portal), as long as you have sent your events for those financial years via our system. Please contact the ST support team with more information and we will advise the next steps. ST Plus offers additional tools for managing historical data and corrections.

No. Employees should log into their personal myGov account and find their earning statements under the Income statement section.

You can invite all of your team members or accountant to use the system and assign them appropriate access to your entity (company) at no extra cost.

Each of the Single Touch products (Lite and Portal) have a sandbox for testing purposes:

Sandbox for STP Lite: https://sandbox-lite.singletouch.com.au

Sandbox for STP Portal: https://sandbox.singletouch.com.au

You are welcome to use these for testing, free of charge.

Please be aware that although the test environments appear to look exactly the same as the live websites and has the same processes including confirmation email from the ATO after a pay event transmission, the sandbox payroll data is never used by the ATO and the sandbox sites are for Testing purposes only.

Once you have signed up for STP Portal, you will find more information regarding our API under the Support - Developer guides section. Please note, signing up for an account is free and you will not be charged unless you submit pay events.

Yes, you are able to use our products if your company has a WPN. WPNs have two characters less than ABN so you must provide it in the ABN section with two leading zeroes e.g., 00xxxxxxxxx, where xxxxxxxxx is your WPN.

No. Single Touch is simply a data reporting tool and acts as a gateway between you and the ATO. For all your payment obligations to the ATO, please follow procedure as outlined in your myGov portal.

Our business hours are Monday-Friday 9am to 5pm (AEST), however you can contact the Single Touch support team at all times via email (enquire@singletouch.com.au)

Have another question?

If you have a question about Single Touch that is not covered above, please feel free to contact us.

*see terms and conditions